— August 6, 2021 —

Managing cash flow isn’t easy when you

own and operate a trucking company.

It may seem the more prosperous you become, the more you find yourself juggling expenses such as fuel, insurance, equipment, maintenance, payroll, and taxes. You run daily operations while waiting 30, 60 or more days for payment after you have delivered a load. Currently, the trucking industry has been further put to the test with unprecedented economic turmoil, higher insurance costs, supply chain constraints and a pandemic.

The tipping point comes when you turn down better loads or let maintenance slide to manage cash flow. Ideally your customers would pay promptly and you wouldn’t need a factoring company but that’s not the current situation. If you do not have sufficient funding to keep your business operating, you ultimately will lose customers and opportunities to grow. There has never been a better time to take advantage of factoring as a critical resource and source of immediate relief for peace of mind.

how factoring can help

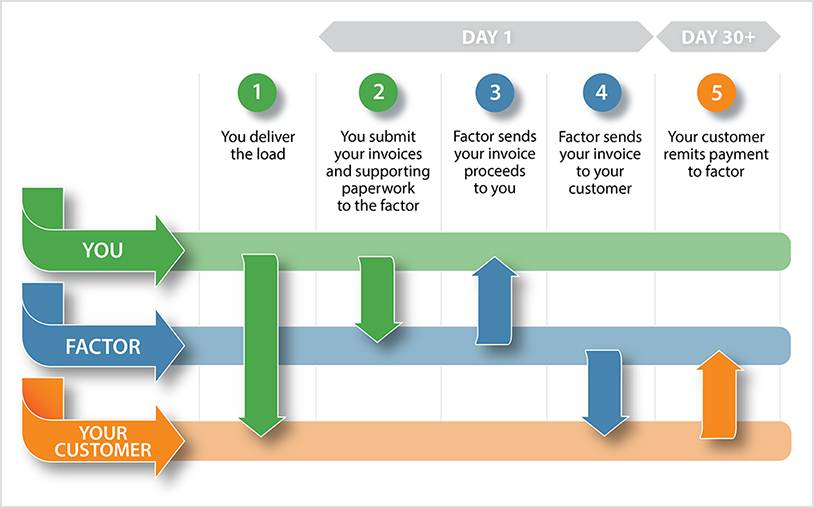

Freight factoring helps common carriers, independent owner-operators who are not leased to carriers, and fleet owners to sell their unpaid invoices at a discount in exchange for immediate cash. No more waiting weeks or months to get paid.

In addition to providing working capital, factoring helps you take control of time-consuming aspects of running your company, such as driver retention, credit-checking, collections, improved record-keeping and back-office support.

driver retention

Imagine being able to take the loads you want and pay your drivers the same or next day following delivery. Freight factoring helps retain the best drivers.

credit-checking new customers

Run free credit checks on prospects 24/7 using a factoring company’s extensive credit database.

collection follow-up

Many business owners struggle finding the time to collect from customers. A factoring company will handle collections for factored invoices on your behalf.

improved record-keeping

Most factors offer clients 24/7 access to important documents through a factoring portal, a free online management tool.

back-office support

Working with a factoring company that understands your transportation segment such as OTR, expedited, intermodal, etc. will add value. They will review your invoices to ensure supporting documentation is correct. The factor will send the invoice to your customer on your behalf.

How to Find the Right Factor for Your Trucking Company

Taking the time to do your homework up front and asking a lot of questions before entering into an agreement will pay big dividends. Referrals are always best since the level of service from factor to factor can vary greatly.

Start by talking to trusted friends and colleagues who have been through up and down economic cycles. They can be an invaluable resource and can make firsthand recommendations for critical services including factoring. See if they can direct you to factoring companies who work in your segment such as intermodal, expedited or dump trucks and can approve your customers whether they are brokers, shippers, steamship lines, freight forwarders or construction companies.

Factoring companies typically determine their fees and advance rates based on a number of criteria, including your sales volume, number of customers and your customers’ creditworthiness. Check with industry associations you belong to as they might have a factoring partner and offer members prenegotiated rates and savings.

Taking the Mystery Out of Invoice Submissions

The average freight bill currently takes 34 days to get paid. That’s a best-case scenario if everything is submitted correctly. Each customer has its own billing submission rules. The who, how and what involved with submitting vary greatly and can be tricky to manage.

Carriers can use their own system to track individual customers’ requirements, or they can rely on a factoring company for this expertise. Key considerations include:

- Where to submit invoices: online, email, EDI or other method?

- What backup documentation to include?

- Who to contact regarding billing questions?

Streamlining these steps will help customers process your payments quicker and give you more available cash to run your business.

Andrea Rogers is Vice President of Orange Commercial Credit (OCC) and has helped over 500 companies grow by achieving steady cash flow and financial stability through factoring. OCC has 40-plus years' experience funding transportation companies. More than 35% of OCC's new business is client referrals.