Higher Advance Rates

Amazing to Work With!

In 2014 we were referred to OCC by a friend. Our first experience with OCC was with Tina in the Sales Dept. Tina was amazing to work with. She answered all of our questions and guided us through the entire set up process. Other factors we were talking with weren’t as willing to help as Tina was no matter what our questions or concerns. She explained everything and made sure we understood.

The Account Managers I have worked with (Kurt, Tiffany & April) have been just as wonderful to work with. They work hard with care and passion to resolve any problems and are so kind to our customers. We use the scanning program to send in invoices, which took some learning on our behalf, but it’s good now. We have daily email contact with April and she’s so responsive to our needs. We cannot say enough good things about our whole experience with OCC. We love them.”

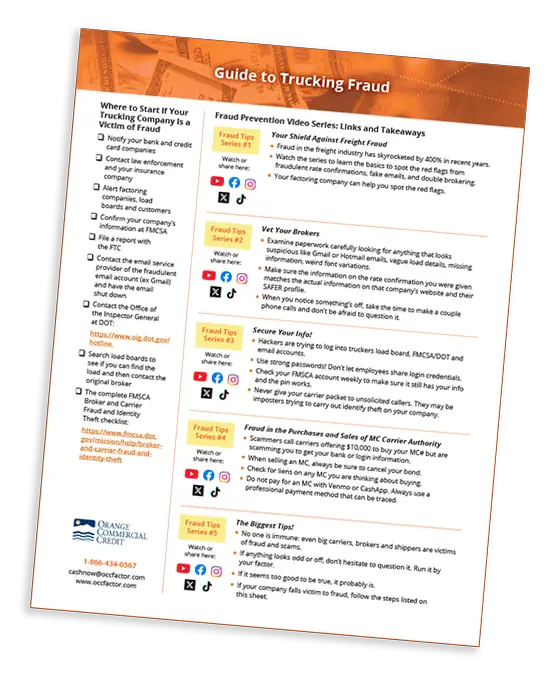

Read All About How to

Leverage this Great Tool

We go the extra mile

Most factoring companies say they have the best offer in the industry with straight-forward contracts, same day funding, no up-front fees, no minimum monthly fees, and so on. BUT….not all factoring companies are created equal. We offer you these same features, but we also go the extra mile for you.

Very few factoring companies can say they have over 45 years industry experience, but we can. We leverage the knowledge of our talented and long-tenured employees to provide you with the utmost in customer care to help your business flourish.

What separates

Orange Commercial Credit?

Our higher advance rates and unmatched level of service

What separates Orange Commercial Credit?

Our higher advance rates and unmatched level of service

Since 1979, factoring has been our primary focus and we’re committed to offering the most effective and versatile trucking programs in the industry. Our deep understanding and expertise of the trucking industry, business credit and finance helps you avoid time-wasting and costly missteps. We guarantee you won’t find a better factor to help you grow your business.

If you have any questions about your particular situation,

don’t hesitate to contact us.

We have the best deals for the

transportation industry!

We have the best deals for

the transportation industry!

We have the

best deals

for the

transportation

industry!

OCC has been providing the industry with fast cash for over 45 years. We keep your wheels in motion.

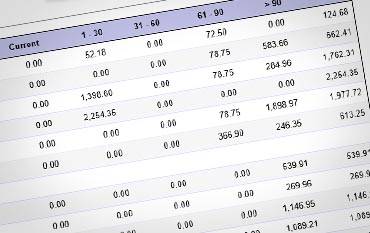

OCC’s freight bill factoring programs offer some of the highest advance rates with no minimum monthly requirements, completely transparent fees, dedicated account representatives, same day funding, electronic submission of invoices, real time account reporting and free access to up-to-date customer credit status.

more reasons why Orange Commercial Credit is The best Factoring Company For Your trucking Business...

more reasons why Orange Commercial Credit is The

best Factoring Company

For Your trucking Business...

more reasons Why Orange Commercial Credit is The best Factoring Company For Your trucking Business...

No other factoring company matches our level of superior service and offerings.

As you can see, Orange Commercial Credit simply has more to offer you.

Other factoring companies don’t even compare.

And Not All Factoring Companies Can Say This:

“More than half of our new business comes through client referrals.”

"They Really Care!"

I made the mistake of not credit checking a load and by the time I turned it into my factor (not OCC) the brokerage was out of business. My factor (not OCC) understandably wouldn’t fund it so I was left not knowing what to do.

I turned to my friend Mike for advice and he referred me to his factor… Maria at OCC. Maria reviewed my paperwork and explained step by step what I needed to do including outlining who to contact, what numbers to reference and what I needed to ask. She carefully explained the pros and cons of different options such as collecting on a bond or pursuing collections and how that might affect my relationship with the shipper and receiver moving forward.

I really appreciated Maria taking the time to do that when I wasn’t even her client. I could see that they really care and understand how big a $4,500 loss is to any trucking company. A & N Transportation Detroit, MI”

So, Will Your Company Benefit from Factoring with Orange Commercial?

Of Course! From small privately-owned companies to large corporations, transporation businesses of all sizes rely on Orange Commercial Credit to boost their bottom lines by increasing cash flow and streamlining accounts receivable processes.

Companies use the cash generated from factoring to pay for fuel, repairs, payroll and equipment—basically any expenses related to their business. Factoring allows a company to make quicker decisions and expand at a faster pace.

Unlike a bank loan, factoring has…

- No principle or interest to pay over time

- No debt to repay

- Unlimited funding potential

- Fast funding – no waiting months like at a bank

- Approval is focused on the strength of your customers, not your credit

- Startups are welcome